| | | | |

| | OMB APPROVAL |

| |

|

| | OMB Number: | | 3235-0059 |

| | Expires: | | February 28, 2006 |

| | Estimated average burden

hours per response | 12.75 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| |

| | Filed by the Registrant xþ |

| | Filed by a Party other than the Registrant o |

| |

| | Check the appropriate box: |

| |

| | o Preliminary Proxy Statement |

| | o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | xþ Definitive Proxy Statement |

| | o Definitive Additional Materials |

| | o Soliciting Material Pursuant to §240.14a-12 |

Tyler Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| | xþ No fee required. |

| | o Fee computed on table below per Exchange Act Rules 14a-6(i)(4)(1) and 0-11. |

| |

| | 1) Title of each class of securities to which transaction applies: |

| |

| | 2) Aggregate number of securities to which transaction applies: |

| |

| | 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | 4) Proposed maximum aggregate value of transaction: |

| |

| | o Fee paid previously with preliminary materials. |

| |

| | o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| | 1) Amount Previously Paid: |

| |

| | 2) Form, Schedule or Registration Statement No.: |

| |

SEC 1913 (02-02) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

March 31, 200626, 2009

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Tyler Technologies, Inc. to be held on Thursday, May 18, 2006,14, 2009, in Dallas, Texas at the Park Cities Hilton, 5954 LutherCity Club, 5956 Sherry Lane, Dallas, Texas,Suite 1700, commencing at 10:009:30 a.m., local time. Details of the business to be conducted at the meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to sign, date, and return the enclosed proxy or vote through the Internet at your earliest convenience. If you decide to attend the annual meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of the Company.

| | | |

| Yours very truly,

JOHN M. YEAMAN

Chairman of the Board

| |

| | |

| | |

| | |

| | | | | |

| | Yours very truly, | | |

|

| | JOHN M. YEAMAN | | |

| | Chairman of the Board | | |

TYLER TECHNOLOGIES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 18, 200614, 2009

To the Stockholders of

TYLER TECHNOLOGIES, INC.:

The annual meeting of stockholders will be held in Dallas, Texas at the Park Cities Hilton, 5954 LutherCity Club, 5956 Sherry Lane, Dallas, Texas, on Thursday, May 18, 2006,Suite 1700, at 10:009:30 a.m., Dallaslocal time. At the meeting, you will be asked to:

| | (1) | | elect seven directors to serve until the next annual meeting or until their respective successors are duly elected and qualified; |

| |

| | (2) | | consider and vote upon a proposal to amend the Tyler Technologies, Inc. Stock Option Plan (the “Stock Option Plan”) to increase the number of shares of our common stock subject to the Stock Option Plan by 1,000,000 shares; |

|

| (3) | | ratify the selection of Ernst & Young LLP as our independent auditors for fiscal year 2006;2009; and |

| |

| | (4)(3) | | transact such other business as may properly come before the meeting. |

Only stockholders of record on March 31, 200617, 2009 may vote at the annual meeting. A list of those stockholders will be available for examination at our corporate headquarters, 5949 Sherry Lane, Suite 1400, Dallas, Texas 75225, from May 85 through May 18, 2006.14, 2009.

Please date and sign the enclosed proxy card and return it promptly in the enclosed envelope.envelope or vote through the Internet as described in the enclosed proxy card.No postage is required if the proxy card is mailed in the United States. Your prompt response will reduce the time and expense of solicitation.

The enclosed 20052008 Annual Report does not form any part of the proxy solicitation material.

| | | | | |

| | | By Order of the Board of Directors

H. Lynn Moore, Jr.

Executive Vice President,

General Counsel, and Secretary

| |

| | |

| | | | | |

| | | H. Lynn Moore, Jr. | | |

| | | Vice President, General Counsel, and Secretary | | |

Dallas, Texas

March 31, 200626, 2009

1

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

to be held May 18, 200614, 2009

TABLE OF CONTENTS

| | | | | |

| | | Page | |

| | | 3 | |

| | | 3 | |

| | | 3 | |

| | | 3 | |

| | | 3 | |

| | | 3 | |

| | | 4 | |

| | | 4 | |

| | | 4 | |

Proposal Three –— Ratification of Ernst & Young LLP as Our Independent Auditors for Fiscal Year 20062009 | | | 74 | |

| | | 5 | |

| | | 85 | |

| | | 85 | |

| | | 7 | |

| | | 107 | |

| | | 107 | |

| | | 118 | |

| | | 118 | |

| | | 129 | |

| | | 129 | |

| | | 129 | |

| | | 1410 | |

| | | 14 | |

Director Compensation | | | 1411 | |

| | | 12 | |

| | | 12 | |

| | | 14 | |

| | | 14 | |

| | | 14 | |

| | | 14 | |

| | | 15 | |

Section 16(a) Beneficial Ownership Reporting Compliance | | | 1716 | |

| | | 20 | |

| | | 21 | |

| | | 21 | |

| | | 21 | |

| | | 22 | |

| | | 23 | |

| | | 1723 | |

Option | | | 1824 | |

Option Exercises in 2005 and | | | 1825 | |

Employment Contracts | | | 1926 | |

| | | 26 | |

| | | 27 | |

| | | 19 | |

Report of the Compensation Committee on Executive Compensation | | | 1928 | |

| | | 21 | |

| | | 2228 | |

| | | 2329 | |

| | | 2329 | |

2

THE ANNUAL MEETING

Place, Date, and Time

The annual meeting will be held in Dallas, Texas at the Park Cities Hilton, 5954 LutherCity Club, 5956 Sherry Lane, Dallas, TexasSuite 1700, on Thursday, May 18, 2006,14, 2009, at 10:009:30 a.m., Dallaslocal time.

Matters to be Considered

At the annual meeting, you will be asked to consider and vote upon the following proposals:

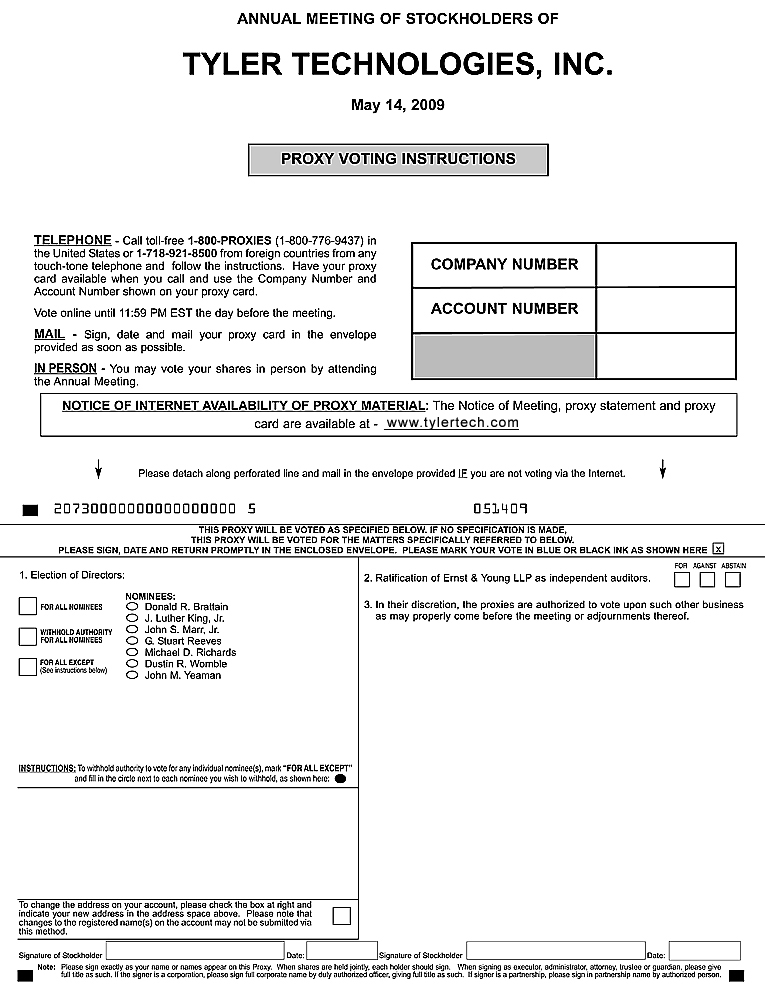

| | • | | Proposal One –— Election of seven directors to serve until the next annual meeting or until their respective successors are duly elected and qualified; and |

| |

| | • | | Proposal Two – Amendment to the Stock Option Plan increasing the number of shares of common stock subject to issuance under the Option Plan from 7,500,000 to 8,500,000; and |

|

| • | | Proposal Three –— Ratification of the selection of Ernst & Young LLP as our independent auditors for fiscal year 2006.2009. |

Record Date and Voting

Only stockholders of record on March 31, 200617, 2009 are entitled to vote at the annual meeting. On March 31, 2006,17, 2009, we had 39,227,63735,252,630 shares of common stock issued and outstanding. Each stockholder will be entitled to one vote, in person or by proxy, for each share of common stock held in his or her name. A majority of our shares of common stock must be present, either in person or by proxy, to constitute a quorum for action at the meeting. Abstentions and broker nonvotes are counted for purposes of determining a quorum. Abstentions are counted in tabulating the votes cast on any proposal, but are not counted as votes either for or against a proposal. Broker nonvotes are not counted as votes cast for purposes of determining whether a proposal has been approved.

Vote Required

The following is the required vote necessary to approve each of the proposals:

| | • | | Proposal One –— Election of Directors –— the election of directors is determined by plurality vote; and |

| |

| | • | | Proposal Two – Amendment to Stock Option Plan – the affirmative vote of holders of a majority of the voting power of the shares actually voted at the annual meeting is required to approve the amendment to the Stock Option Plan; and |

|

| • | | Proposal Three –— Ratification of Ernst & Young LLP –— the affirmative vote of holders of a majority of the voting power of the shares actually voted at the annual meeting is required to ratify Ernst & Young LLP as our independent auditors for fiscal year 2006.2009. |

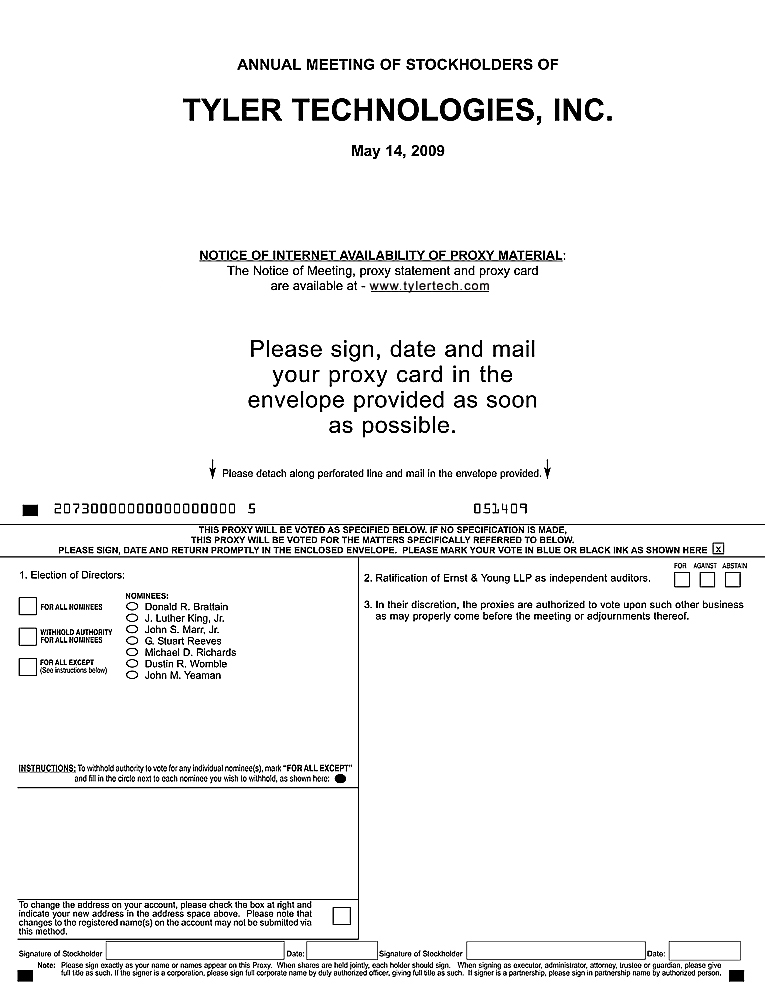

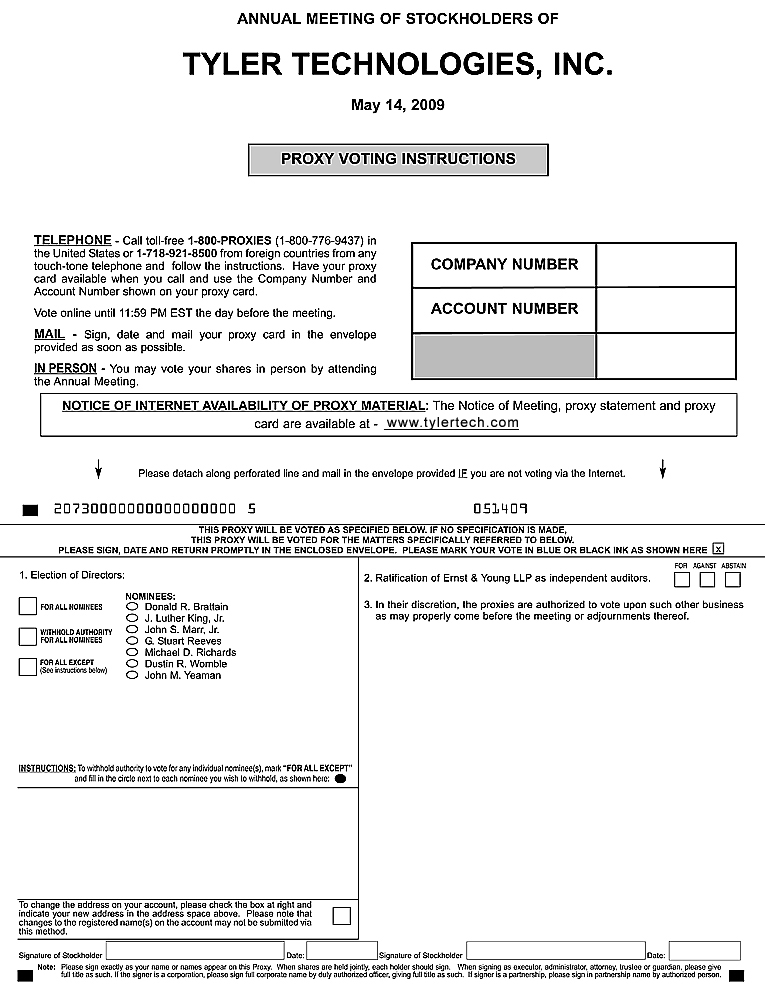

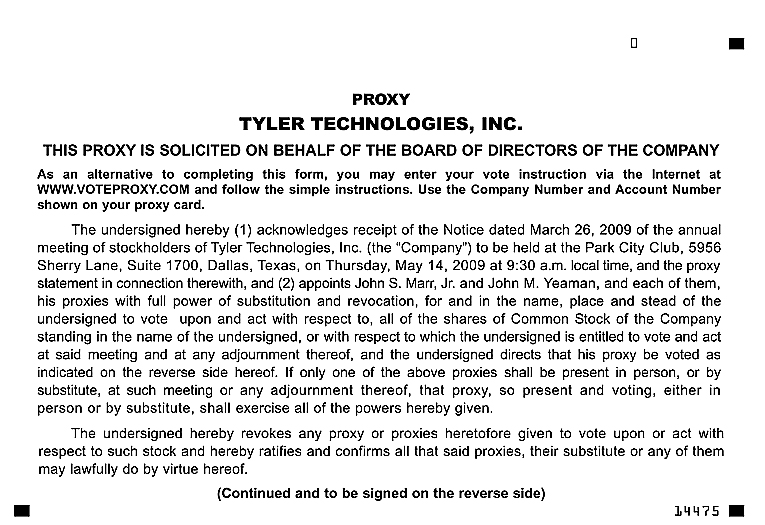

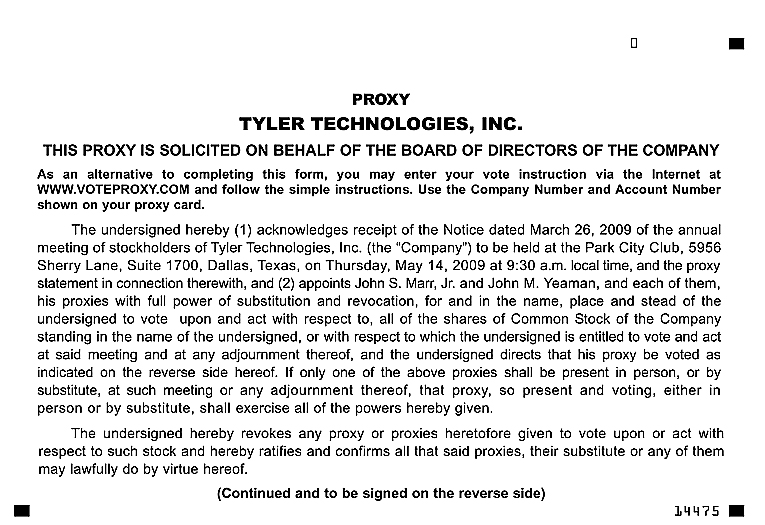

Proxy Solicitation, Revocation, and Expense

The accompanying proxy is being solicited on behalf of the board of directors. Your shares will be voted at the annual meeting as you direct in the enclosed proxy or through the Internet, provided that it is completed, signed, and returned to us prior to the annual meeting. No proxy can vote for more than seven nominees for director. If you return a proxy but fail to indicate how you wish your shares to be voted, then your shares will be voted in favor of each of the nominees for director.

3

After you sign and return your proxy, you may revoke it prior to the meeting either by (i) filing a written notice of revocation at our corporate headquarters, (ii) attending the annual meeting and voting your shares in person, or (iii) delivering to us another duly executed proxy that is dated after the initial proxy.

We will bear the expense of preparing, printing, and mailing the proxy solicitation material and the proxy. In addition to use of the mail, we may solicit proxies by personal interview or telephone by our directors, officers, and employees. We may also engage the services of a proxy solicitation firm to assist us in the solicitation of proxies. We estimate that the fee of any such firm will not exceed $10,000 plus reimbursement of reasonable out-of-pocket expenses. Arrangements may also be made with brokerage houses and other custodians, nominees, and fiduciaries for the forwarding of solicitation material to record stockholders, and we may reimburse them for their reasonable out-of-pocket expenses.

3

PROPOSALS FOR CONSIDERATION

Proposal One –— Election of Directors

At the annual meeting, you will be asked to elect a board of seven directors. The nominees for director are: Donald R. Brattain; J. Luther King, Jr.; John S. Marr, Jr.; G. Stuart Reeves; Michael D. Richards; Dustin R. Womble; and John M. Yeaman. Each of the nominees currently serves on our board of directors. For more information regarding these nominees, see “Tyler Management – Directors, Nominees for Director, and Executive Officers.Management.”

Each nominee has indicated that he is able and willing to serve as a director. If any of the nominees becomes unable to serve prior to the meeting, the persons named in the enclosed proxy will vote the shares covered by your executed proxy for a substitute nominee as selected by the board of directors. You may withhold authority to vote for any nominee by entering his name in the space provided on the proxy card.

Our board of directors unanimously recommends that the stockholders voteFOR each of the nominees for director.

Proposal Two – Amendment to the Stock Option Plan

At the annual meeting, you will also be asked to consider and vote upon a proposal to amend the Stock Option Plan to increase the number of shares of common stock subject to the plan from 7,500,000 to 8,500,000. The proposed amendment to the plan is intended to enable us to provide additional incentives to selected key employees whose substantial contributions are important to our continued growth and profitability. Currently, there are only 53,461 shares of our common stock available for option grants under the existing plan. Copies of the Stock Option Plan are available upon written request.

Purpose of the Stock Option Plan. Stock options are designed to strengthen the commitment of selected key employees, directors, and consultants, to motivate those individuals to perform their assigned responsibilities diligently and skillfully, and to attract and retain competent entrepreneurial-type management dedicated to our long-term growth and profitability. We believe this can best be accomplished by tying a portion of compensation to appreciation in the market value of our common stock so that the management and key employees, non-employee directors, and consultants are rewarded only if the value of your investment in our common stock has appreciated.

4

Description of the Stock Option Plan. The Stock Option Plan is designed to permit the appropriate administering committee to grant options to key employees, directors, and consultants to purchase shares of our common stock. The plan requires that the purchase price under each stock option will not be less than 100% of the fair market value of our common stock at the time of the grant of the option. The fair market value per share is the reported closing price of our common stock on the New York Stock Exchange on the date of the grant of the option, or if no sale has been reported on such date, on the next preceding day or the last day prior to the date of grant when the sale was reported. The option period may not be more than ten years from the date the option is granted. Except with respect to options granted to officers and directors, the Executive Committee grants options to eligible individuals, determines the purchase price and option period at the time the option is granted, and administers and interprets the plan. The Compensation Committee grants options and administers the plan with respect to officers, and our board of directors, as a whole, grants options and administers the plan with respect to directors. Options may be exercised in annual installments as specified by the administering committee or, if applicable, our board of directors. All installments that become exercisable are cumulative and may be exercised at any time after they become exercisable until expiration of the option. The Stock Option Plan contains provisions governing “Changes of Control”, as defined therein, including accelerated vesting of options under certain circumstances.

The exercise price of options is paid in cash or by check at the time of exercise or, if approved, by the tender of shares of our common stock, or through a combination thereof; provided that such shares either: (i) have been owned by the optionee for more than six months and have been “paid for” within the meaning of Rule 144 promulgated under the Securities Act of 1933; or (ii) were obtained by the optionee in the public market (“Qualifying Shares”). If the option is exercised by tendering Qualifying Shares, the number of shares tendered shall be determined by the fair market value per share on the date of the exercise, as determined by us. An option agreement may also provide that the exercise price may be paid through the cashless exercise method whereby the optionee authorizes a broker designated by us to sell a specified number of the shares of common stock to be acquired by the optionee on the exercise of the option, having a then fair market value equal to the sum of the exercise price of the option, plus any transaction costs. The remainder of the shares not sold will be delivered to the optionee. Shares of common stock deliverable upon exercise of the options may be transferred from treasury or issued from authorized but unissued shares.

The Stock Option Plan will terminate on May 11, 2010, and no options may thereafter be granted under the plan. Our board of directors may amend, alter, or discontinue the plan, or any part thereof, at any time and for any reason. However, we will obtain shareholder approval for any amendment to the plan to the extent necessary and desirable to comply with applicable law. The administering committee may also make appropriate adjustments in the number of shares covered by the plan, the number of shares subject to outstanding options, and the option prices to reflect any stock dividend, stock split, share combination, or other recapitalization and, with respect to outstanding options and option prices, to reflect any merger, consolidation, reorganization, liquidation or similar transaction.

Incentive stock options and nonqualified stock options may be granted under the plan to our key employees. Key employees are defined in the plan to be those employees whose performance and responsibilities are determined to have a direct and significant effect on our success. Non-employee directors, as well as consultants, are eligible for the grant of nonqualified stock options. Additional options may be granted to persons to whom options have previously been granted. There is no restriction in the plan on the maximum or minimum number of shares covered by options that may be granted to any person.

Incentive stock options are options that meet the requirements of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), and nonqualified stock options are options that do not meet the requirements of Section 422 of the Code. No incentive stock option, however, may be granted under the Stock Option Plan to an employee who owns more than 10% of the voting power of all classes of securities unless the option price is at least 110% of the fair market value of our common stock at the date of grant and the option is not exercisable more than five years after it is granted. There is no limit on the fair market value of incentive stock options that may be granted to an employee in any calendar year, but no employee may be granted incentive stock options that first become exercisable during a calendar year for the purchase of stock with an aggregate fair market value

5

(determined as of the date of grant of each option) in excess of $100,000. An incentive stock option (or an installment thereof) counts against the annual limitation only in the year it first becomes exercisable.

The appropriate administering committee may provide for the termination of options in case of termination of employment, directorship, consultant relationship, dishonesty, or any other reason the appropriate committee determines. If an option expires or terminates before it has been exercised in full, the shares of common stock allocable to the unexercised portion of that option may be made the subject of future grants of options. Upon termination of the employment, directorship, or consultant relationship of an optionee, his or her option is exercisable for a period of 30 days after termination, and thereafter the option terminates. If the optionee dies or becomes disabled before the termination of his right to exercise his or her option, the legal representatives of the estate, or the optionee in the event of his disability, may exercise his or her option provided the option is exercised prior to the date of expiration of the option period or one year from the date of the optionee’s death or disability, whichever first occurs, and the option may be exercised only as to those shares the optionee could have purchased under the option on the date of death, disability or other termination. Options may not be transferred other than by will or the laws of descent and distribution and, during the lifetime of the optionee, may be exercised only by him.

Tax Status of Options. An optionee has no taxable income, and we are not entitled to a deduction, at the time of the grant of an option. All stock options that qualify under the rules of Section 422 of the Code will be entitled to “incentive stock option” treatment. To receive incentive stock option treatment, an optionee must not dispose of the acquired stock within two years after the option is granted and within one year after the exercise. In addition, the individual must have been an employee for the entire time from the date of granting of the option until three months (one year if the employee is disabled) before the date of the exercise. The requirement that the individual be an employee and the two-year and one-year holding periods are waived in the case of death of the employee. If all such requirements are met, then any gain upon sale of the stock will be entitled to capital gain treatment. The employee’s gain on exercise (the excess of the fair market value at the time of exercise over the exercise price) of an incentive stock option is a tax preference item and, accordingly, is included in the computation of alternative minimum taxable income, even though it is not included in taxable income for purposes of determining regular tax liability of an employee. Consequently, an optionee may be obligated to pay alternative minimum tax in the year he or she exercises an incentive stock option.

If an employee does not meet the two-year and one-year holding requirement (a “disqualifying disposition”), tax will be imposed at the time of sale of the stock. In such event, the employee’s gain on exercise of the incentive stock option will be compensation to him taxed as ordinary income rather than capital gain to the extent the fair market value of the acquired common stock on the date of exercise of the incentive stock option exceeds the aggregate exercise price paid for that common stock, and we will be entitled to a corresponding deduction at the time of sale. If the amount realized on the disqualifying disposition is less than the fair market value of the common stock on the date of exercise of the incentive stock option, the total amount includable in optionee’s gross income, and the amount deductible by us, will equal the excess of the amount realized on the disqualifying disposition over the exercise price.

An optionee, upon exercise of a nonqualified stock option that does not qualify as an incentive stock option, recognizes ordinary income in an amount equal to the gain on exercise. The exercise of a nonqualified stock option entitles us to a tax deduction in the same amount as is includable in the income of the optionee for the year in which the exercise occurred. Any gain or loss realized by an optionee on subsequent disposition of shares generally is a capital gain or loss and does not result in any tax deduction to us.

Different tax consequences may result from stock-for-stock exercises of options.

THE FOREGOING SUMMARY OF THE EFFECT OF THE FEDERAL INCOME TAX UPON PARTICIPANTS IN THE STOCK OPTION PLAN DOES NOT PURPORT TO BE COMPLETE, AND IT IS RECOMMENDED THAT THE PARTICIPANTS CONSULT THEIR OWN TAX ADVISORS FOR COUNSELING. MOREOVER, THE FOREGOING SUMMARY IS BASED UPON PRESENT FEDERAL INCOME TAX LAWS AND IS SUBJECT TO CHANGE. THE TAX TREATMENT UNDER FOREIGN, STATE, OR LOCAL LAW IS NOT COVERED IN THIS SUMMARY.

Our board of directors unanimously recommends that the stockholders voteFOR the amendment to the Stock Option Plan.

6

Proposal Three –— Ratification of Ernst & Young LLP as Our Independent Auditors for Fiscal Year 20062009

The Audit Committee has selected Ernst & Young LLP, independent registered public accounting firm, as our independent auditors for fiscal year 2006,2009, subject to ratification by the stockholders. Ernst & Young LLP served as our independent auditors for fiscal years 20052008 and 2004.2007. A representative of Ernst & Young LLP is expected to be present at the annual meeting. That representative will have an opportunity to make a statement, if desired, and will be available to respond to appropriate questions.

|

| | Ernst & Young’s fees for all professional services during each of the last two fiscal years were as follows: |

| | | | | | | | | | |

| | | | | | | | | | | 2008 | | 2007 | |

| | | 2005 | | 2004 | |

| Audit Fees | | $ | 967,000 | | $ | 1,264,000 | | | $ | 1,095,000 | | $ | 1,069,000 | |

| Audit Related Fees | | 42,000 | | 80,000 | | | 63,000 | | 51,000 | |

| Tax Fees | | 10,500 | | 7,000 | | | 19,000 | | 11,000 | |

| Other Fees | | 4,500 | | 4,500 | | |

| | | | | | | | | | | |

| Total | | $ | 1,024,000 | | $ | 1,355,500 | | | $ | 1,177,000 | | $ | 1,131,000 | |

Audit Fees. Fees for audit services include fees associated with the annual audit, the review of our interim financial statements, and the auditor’s opinions related to internal control over financial reporting required by Section 404 of the Sarbanes-Oxley Act.

Audit-Related Fees. Fees for audit-related services generally include fees for accounting consultations SEC filings, assistance with our documentation to comply with Section 404 of Sarbanes-Oxley Act, and audit of our employee benefit plan.Securities and Exchange Commission (“SEC”) filings.

Tax Fees. Fees for tax services include fees for tax consulting and tax compliance and preparation work.

All Other Fees. Fees for access to Ernst & Young’s online research tool.compliance.

The Audit Committee approved all of the independent auditors’auditor engagements and fees presented above. Our Audit Committee Charter requires that the Audit Committee pre-approve all audit and non-audit services provided to us by our independent auditors. All such services performed in 20052008 were pre-approved by the Audit Committee. For more information on these policies and procedures, see “Corporate Governance Principles and Board Matters –— Pre-Approval Policies and Procedures for Audit and Non-Audit Services.”

Our board of directors unanimously recommends that the stockholders voteFOR the ratification of Ernst & Young LLP as our independent auditors for fiscal year 2006.2009.

74

TYLER MANAGEMENT

Directors, Nominees for Director, and Executive Officers

Below is a brief description of our directors, nominees for director, and executive officers. Each director holds office until our next annual meeting or until his successor is elected and qualified. Executive officers are elected annually by the board of directors and hold office until the next annual board meeting or until their successors are elected and qualified.

Directors, Nominees for Director, and Executive Officers

| | | | | | | |

| Name / Age | | Present Position | | Served Since | |

| | | | | | |

John M. Yeaman, 6568 | | Chairman of the Board | | | 2004 | |

| | | Director | | | 1999 | |

John S. Marr, Jr., 4649 | | President and Chief Executive Officer | | | 2004 | |

| | | Director | | | 2002 | |

Donald R. Brattain, 6568 | | Director | | | 2004 | |

J. Luther King, Jr., 6669 | | Director | | | 2004 | |

G. Stuart Reeves, 6669 | | Director | | | 2001 | |

Michael D. Richards, 5558 | | Director | | | 2002 | |

Dustin R. Womble, 4649 | | Executive Vice President | | | 2003 | |

| | | Director | | | 2005 | |

Brian K. Miller, 4750 | | SeniorExecutive Vice President and | | | 2008 | |

| | Chief Financial Officer | | | 2005 | |

| | | Treasurer | | | 1997 | |

H. Lynn Moore, Jr., 3841 | | Executive Vice President and | | | 2008 | |

| | Secretary | | | 2000 | |

| | | General Counsel | | | 1998 | |

Glenn A. Smith, 52 | | Executive Vice President | | | 2003 | |

Business Experience of Directors, Nominees for Director, and Executive Officers

John M. Yeamanhas served as Chairman of the Board since July 2004. From April 2002 until July 2004, Mr. Yeaman served as President and Chief Executive Officer; from March 2000 until April 2002, he served as President and Co-Chief Executive Officer; and from December 1998 until March 2000, he was President and Chief Executive Officer. Mr. Yeaman was elected to our board of directors in February 1999. Mr. Yeaman also serves as Chairman of the Executive Committee. From 1980 until 1998, Mr. Yeaman was associated with Electronic Data Systems Corporation (“EDS”), where he most recently served as the director of a worldwide Strategic Support Unit managing $2 billion in real estate assets. Mr. Yeaman began his career with Eastman Kodak Company. Mr. Yeaman also serves on the Board of Directors of Park Cities Bank in Dallas, Texas.

John S. Marr, Jr.has served as President and Chief Executive Officer since July 2004. From July 2003 until July 2004, Mr. Marr served as Chief Operating Officer. Mr. Marr has served on our board of directors since May 2002 and is currently a member of the Executive Committee. Mr. Marr also served as President of MUNIS, Inc. (“MUNIS”) from 1994 until July 2004. Mr. Marr began his career in 1983 with MUNIS, a company that develops and marketsprovider of a wide range of software products and related services for county and city governments, schools, and not-for-profit organizations, with a focus on integrated financial systems. We acquired MUNIS in 1998.1999. Mr. Marr also serves on the board of directors of Mercy Hospital in Portland, Maine.

Donald R. Brattainhas served as a director since 2004. Mr. Brattain also serves as Chairman of the Audit Committee and is a member of the Nominating and Governance Committee. Since 1985, Mr. Brattain has served as President of Brattain & Associates, LLC, a private investment company founded by Mr. Brattain in 1985 and located in Minneapolis, Minnesota. From 1981 until 1988, Mr. Brattain purchased and operated Barefoot Grass Lawn Service Company, a company that grew from $3.2 million in sales to over $100 million in sales and was sold to ServiceMaster, Ltd. in 1998.

8

J. Luther King, Jr.has served as a director since 2004. Mr. King also serves on the Audit Committee and the Compensation Committee. Mr. King is the Chief Executive Officer Chief Financial Officer, and a directorPresident of Luther King Capital

5

Management (“LKCM”), a registered investment advisory firm that he founded in 1979. Mr. King also serves as a director and a member of the UniversityAudit Committee of Texas Investment Management Company (“UTIMCO”), a company that manages the endowment assets of the University of Texas system and a portion of the endowment assets of Texas A&M University.Encore Energy Partners GP, LLC. In addition, Mr. King serves as a director on various private and non-profit entities and foundations, including Chairman of the CompensationBoard of Trustees of Texas Christian University, Advisory Committee of UTIMCO.the Employees Retirement System of Texas, Trustee of LKCM Funds and director of Hunt Forest Products, Inc. Mr. King has a Bachelor of Science degree and a Masters of Business Administration from Texas Christian University, and he is also a Chartered Financial Analyst.

G. Stuart Reeveshas served on our board of directors since June 2001. Mr. Reeves also serves as Chairman of the Nominating and Governance Committee and is a member of the Audit Committee and the Compensation Committee. From 1967 to 1999, Mr. Reeves worked for EDS, a professional services company that offers its clients a portfolio of related systems worldwide within the broad categories of systems and technology services, business process management, management consulting, and electronic business. During his thirty-two years of service with EDS, Mr. Reeves held a variety of positions, including Executive Vice President, North and South America, from 1996 to 1999; Senior Vice President, Europe, Middle East, and Africa, from 1990 to 1996; Senior Vice President, Government Services Group, from 1988 to 1990; Corporate Vice President, Human Resources, from 1984 to 1988; Corporate Vice President, Financial Services Division, from 1979 to 1984; Project Sales Team Manager, from 1974 to 1979; and Systems Engineer and Sales Executive, from 1967 to 1974. Mr. Reeves also served on the EDS Board of Directors from 1988 until 1996. Mr. Reeves retired from EDS in 1999. Mr. Reeves also serves on the Board of GovernorsDirectors of Park Cities Bank in Dallas, Texas. Mr. Reeves has Bachelor of Science and Master of Science degrees in Mathematics from Oklahoma State University Foundation.University.

Michael D. Richardshas served on our board of directors since May 2002. Mr. Richards also serves as Chairman of the Compensation Committee and is a member of the Nominating and Governance Committee. Mr. Richards is Executive Vice President of Republic Title of Texas, Inc. From September 2000 until September 2005, Mr. Richards served as Chairman and Chief Executive Officer of Suburban Title, LLC d/b/a Reunion Title, an independent title insurance agency founded by Mr. Richards in September 2000 and which he sold to Republic Title in September 2005. From 1989 until September 2000, Mr. Richards served as President and Chief Executive Officer of American Title Company, Dallas, Texas, an affiliate of American Title Group, Inc., one of the largest title insurance underwriters in Texas during that time. From 1982 until 1989, Mr. Richards held various management positions with Hexter-Fair Title Company, Dallas, Texas, including President from 1988 until 1989. From 1974 until 1982, Mr. Richards worked for Stewart Title Guaranty Company, Dallas, Texas, during which time he held several key management positions including serving on its board of directors. Mr. Richards holds several positions with various associations, some of which include: Greater Dallas Chamber of Commerce, member of the Economic Development Advisory Council; Leukemia Society of America, Advisory Board Member; Greater Dallas Association of Realtors, Board Member; and Home Builders Association, Board Member.Member; and member of the executive committee of the Texas Stampede.

Dustin R. Womblehas been Executive Vice President in charge of corporate-wide product strategy, Chief Executive Officer of both our Courts and Justice division and our INCODE division since July 2003. Mr. Womble has served on our board of directors since May 20052006 and is currently a member of the Executive Committee. From July 2003 to June 2006, Mr. Womble has alsowas Executive Vice President in charge of corporate-wide product strategy and President of our INCODE division. Mr. Womble previously served as President of our INCODE Division sincedivision from 1998, when we acquired INCODE. INCODE, develops, implements, and supports software and services for local governments. INCODE focuses on enterprise wide solutions that address integrated financial systems, customer service, and law enforcement for counties, cities, and towns.to July 2003.

Brian K. Millerhas been SeniorExecutive Vice President — Chief Financial Officer and Treasurer since February 2008. From May 2005.2005 until February 2008, Mr. Miller served as Senior Vice President — Chief Financial Officer and Treasurer. He previously served as Vice President –— Finance and Treasurer from May 1999 to April 2005 and was Vice President — Chief Accounting Officer and Treasurer from December 1997 to April 1999. From June 1986 through December 1997, Mr. Miller held various senior financial management positions at Metro Airlines, Inc. (“Metro”), a publicly-held regional airline holding company operating as American Eagle. Mr. Miller was Chief Financial Officer of Metro from May 1991 to December 1997 and also held the office of President of Metro from January 1993 to December 1997. Mr. Miller is a certified public accountant.

H. Lynn Moore, Jr.has been General Counsel since September 1998 and has been Vice President and Secretary since October 2000.2000 and Executive Vice President since February 2008. He previously served as Vice President from October 2000 until February 2008. From August 1992 to August 1998, Mr. Moore was associated with the law firm of Hughes & Luce, L.L.P. in Dallas, Texas where he represented numerous publicly-held and privately-owned entities

6

in various corporate and securities, finance, litigation, and other legal related matters. Mr. Moore is a member of the State Bar of Texas.

9

Glenn A. Smithhas served as Executive Vice President since July 2003 and is President of our Courts and Justice Division. Mr. Smith also served on our board of directors from June 2001 until May 2005. In 1981, Mr. Smith co-founded The Software Group, Inc. (“TSG”), a company that develops and markets a wide range of software products and related services for county governments, with a focus on integrated judicial management and law enforcement systems. We acquired TSG in 1998. Prior to founding TSG, Mr. Smith was employed at Distributed Data Systems of Raleigh, North Carolina, in a software development project management capacity and, prior to that, at Texas Instruments Incorporated in Dallas, Texas as a software developer.

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Corporate Governance InitiativesGuidelines

Our board of directors has adopted a number of corporate governance initiatives,guidelines, including the following:

| | • | | Independence Standards, which determine the independence of our non-employee directors. These standards are consistent with the independence standards set forth in Rule 303A.02(b) of the New York Stock Exchange Listed Company Manual. The Independence Standards are included as an exhibit to our Audit Committee Charter. |

| |

| | • | | Corporate Governance Guidelines, which include, among other things: |

| | • | | annual submission of independent auditors to stockholders for approval; |

| |

| | • | | formation of a Nominating and Governance Committee to be comprised solely of independent directors; |

|

| | • | | prohibition of stock option re-pricing; |

| |

| | • | | formalization of the ability of independent directors to retain outside advisors; |

| |

| | • | | performance of periodic formal board evaluation; and |

| |

| | • | | limitation on the number of additional public company boards on which a director may serve to a maximum of four. |

A copy of our Corporate Governance Guidelines may be found on our Website, www.tylerworks.com.

| | | A copy of our Corporate Governance Guidelines may be found on our Website, www.tylertech.com. |

|

| | • | | An Audit Committee Charter, which requires, among other things, that the committee be comprised solely of independent directors (as set forth in the Independence Standards), at least one of who will qualify as an “audit committee financial expert” as set forth in Item 401(h) of the SEC’s Regulation S-K. A copy of our Audit Committee Charter may be found on our Website,www.tylerworks.comwww.tylertech.com.. |

| |

| | • | | A Compensation Committee Charter, which requires, among other things, that the committee be comprised solely of independent directors and sets forth the guidelines for determining executive compensation. A copy of our Compensation Committee Charter may be found on our Website, www.tylerworks.com.www.tylertech.com. |

| |

| | • | | A Nominating and Governance Committee Charter, which requires, among other things, that the committee be comprised of at least three independent directors who are responsible for recommending candidates for election to the board of directors. A copy of our Nominating and Governance Committee Charter may be found on our Website, www.tylerworks.com.www.tylertech.com. |

Code of Business Conduct and Ethics

Our board of directors has adopted a Code of Business Conduct and Ethics, which applies to all of our directors, executive officers (including, without limitation, the chief executive officer, chief financial officer, principal accounting officer, and controller), and employees. The purpose of the Code of Business Conduct and Ethics is to promote:

10

| | • | | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| |

| | • | | full, fair, accurate, timely, and understandable disclosure in our public communications and reports filed with the SEC; |

| |

| | • | | compliance with applicable governmental laws, rules, and regulations; |

| |

| | • | | prompt internal reporting of violations of the policy to the appropriate persons designated therein, including anonymous “whistleblower” provisions; and |

|

| • | | accountability for adherence to the policy. |

7

accountability for adherence to the policy.

A copy of our Code of Business Conduct and Ethics may be found on our Website, www.tylerworks.com,www.tylertech.com, or will be furnished, without charge, upon written request at our principal executive offices. Any future amendments or waivers related to our Code of Business Conduct and Ethics will be promptly posted on our Website.

Board Independence

Our board of directors has determined, after considering all of the relevant facts and circumstances, that each of the non-employee directors standing for re-election as director (Messrs. Brattain, King, Reeves, and Richards) has no material relationship with us (either directly or as a partner, shareholder, or officer of an organization that has a relationship with us) and is “independent” within the meaning of the New York Stock Exchange director independence standards, as currently in effect and as may be changed from time to time. As a result, if each of the nominees for director is elected at the annual meeting, our board of directors will be comprised of a majority of “independent” directors as required by the New York Stock Exchange. Furthermore, our board of directors has determined that each of the members of the Audit Committee, Compensation Committee, and Nominating and Governance Committee has no material relationship with us (either directly or as a partner, shareholder, or officer of an organization that has a relationship with us) and is “independent” within the meaning of our director independence standards.

Committees and Meetings of the Board of Directors

During 2005, the standing committees of our board of directors were the Audit Committee, Compensation Committee, Executive Committee, and Nominating and Governance Committee. The board met fourseven times during 2005.2008. Each board member participated in at least 75% of all board and committee meetings held during the portion of 20052008 that he served as a director and/or committee member. In addition, our board of directors has established a policy under which our non-management members will meet at regularly scheduled (and in any event at least twice per fiscal year) executive sessions without management present and with Mr. G. Stuart Reeves presiding over such meetings. During 2008, the standing committees of our board of directors were the Audit Committee, Compensation Committee, Executive Committee, and Nominating and Governance Committee.

Audit Committee.During 2005,2008, the Audit Committee was comprised of Donald R. Brattain (Chairman), J. Luther King, Jr., and G. Stuart Reeves, each of whowhom is “independent” as defined above. The Audit Committee’s duties include:

| | • | | considering the independence of our independent auditors before we engage them; |

| |

| | • | | reviewing with the independent auditors the fee, scope, and timing of the audit; |

| |

| | • | | reviewing the completed audit with the independent auditors regarding any significant accounting adjustments, recommendations for improving internal controls, appropriateness of accounting policies, appropriateness of accounting and disclosure decisions with respect to significant unusual transactions or material obligations, and significant findings during the audit; |

| |

| | • | | performance of periodic formal committee evaluations; |

|

| • | | reviewing our financial statements and related regulatory filings with the independent auditors; and |

| |

| | • | | meeting periodically with management to discuss internal accounting and financial controls. |

The Audit Committee met fourfive times during 2005.2008.

11

Compensation Committee. During 2005,2008, the Compensation Committee was comprised of Michael D. Richards (Chairman), J. Luther King, Jr., and G. Stuart Reeves. The Compensation Committee has final authority on all executive compensation and periodically reviews compensation and other benefits paid to or provided for our officers and directors. The Compensation Committee also approves annual salaries, stock option awards and bonuses for executive officers to ensure that the recommended salaries and bonuses are not unreasonable. The Compensation Committee met twice during 2005.2008.

Executive Committee. During 2005,2008, the Executive Committee was comprised of John M. Yeaman (Chairman), John S. Marr, Jr., and Dustin R. Womble. The Executive Committee has the authority to act for the entire board of

8

directors, but may not commit to an expenditure in excess of $5,000,000 without full board approval. The Executive Committee meets periodically throughout the year.

Nominating and Governance Committee.During 2005,2008, the Nominating and Governance Committee was comprised of G. Stuart Reeves (Chairman), Donald R. Brattain, and Michael D. Richards. The Nominating and Governance Committee’s duties include:

| | • | | identifying and recommending candidates for election to our board of directors; |

| |

| | • | | periodically reviewing the appropriate skills and characteristics required of board members in the context of the current make-up of our board; and |

| |

| | • | | monitoring adherence to our “Corporate Governance Guidelines”. |

The Nominating and Governance Committee met once during 2005.2008.

Audit Committee Financial Expert

Our board of directors determined that each of Donald R. Brattain and J. Luther King, Jr., current chairman and member of the Audit Committee, respectively, possesses the attributes necessary to qualify as an “audit committee financial expert” as set forth in Item 401(h) of the SEC’s Regulation S-K.

Pre-Approval Policies and Procedures for Audit and Non-Audit Services

The Audit Committee Charter requires that the Audit Committee pre-approve all of the audit and non-audit services performed by our independent auditors. The purpose of these pre-approval procedures is to ensure that the provision of services by our independent auditors does not impair their independence. Each year, the Audit Committee receives fee estimates from our independent auditors for each category of services to be performed by the independent auditors during the upcoming fiscal reporting year. These categories of services include Audit Services, Audit-Related Services, Tax Services, and All Other Services. Upon review of the types of services to be performed and the estimated fees related thereto, the Audit Committee will determine which services and fees should be pre-approved, which pre-approval will be in effect for a period of twelve months. The Audit Committee may periodically review the list of pre-approved services based on subsequent determinations. Unless a type of service to be provided by the independent auditor has received general pre-approval, it will require specific pre-approval by the Audit Committee (or delegated member of the Audit Committee) prior to the performance of such service. Any proposed services exceeding the pre-approved cost levels will also require specific pre-approval by the Audit Committee (or delegated member of the Audit Committee).

Director Nominating Process

The Nominating and Governance Committee is responsible for reviewing and interviewing qualified candidates to serve on our board of directors and to select both “independent” as well as management nominees for director to be elected by our stockholders at each annual meeting. The Nominating and Governance Committee is comprised solely of independent directors and operates under a Charter for the Nominating and Governance Committee.

Our Corporate Governance Guidelines include the criteria our board of directors believes are important in the selection of director nominees, which includes the following qualifications:

12

| | • | | sound personal and professional integrity; |

| |

| | • | | an inquiring and independent mind; |

| |

| | • | | practical wisdom and mature judgment; |

| |

| | • | | broad training and experience at the policy-making level of business, finance and accounting, government, education, or technology; |

| |

| | • | | expertise that is useful to Tyler and complementary to the background and experience of other board members, so that an optimal balance of board members can be achieved and maintained; |

| |

| | • | | willingness to devote the required time to carrying out the duties and responsibilities of board membership; |

| |

| | • | | commitment to serve on the board for several years to develop knowledge about our business; |

|

9

| | • | | willingness to represent the best interests of all stockholders and objectively appraise management performance; and |

| |

| | • | | involvement only in activities or interests that do not conflict with the director’s responsibilities to Tyler or our stockholders. |

The Nominating and Governance Committee may, in the exercise of its discretion, actively solicit nominee candidates; however, nominee recommendations submitted by other directors or stockholders will also be considered as described below.

The Nominating and Governance Committee will consider qualified nominees recommended by stockholders who may submit recommendations to the committee in care of our Corporate Secretary at our corporate headquarters, 5949 Sherry Lane, Suite 1400, Dallas, Texas 75225. To be considered by the Nominating and Governance Committee, stockholder nominations must be submitted in accordance with our bylaws and must be accompanied by a description of the qualifications of the proposed candidate and a written statement from the proposed candidate that he or she is willing to be nominated and desires to serve, if elected. Nominees for director who are recommended by our stockholders will be evaluated in the same manner as any other nominee for director.

Nominations by stockholders may also be made at an annual meeting of stockholders in the manner provided in our bylaws. Our bylaws require that a stockholder entitled to vote for the election of directors may make nominations of persons for election to our board at a meeting of stockholders by complying with required notice procedures. Nominations must be received at our corporate headquarters not less than 75 days or more than 85 days before any annual meeting of stockholders. If, however, notice or prior public disclosure of an annual meeting is given or made less than 75 days before the date of the annual meeting, the notice must be received no later than the 10th day following the date of mailing of the notice of annual meeting or the date of public disclosure of the date of the annual meeting, whichever is earlier. The notice must specify the following:

as to each person the stockholder proposes to nominate for election or re-election as a director:

| | • | | the name, age, business address, and residence address of the person; |

| |

| | • | | the principal occupation or employment of the person; |

| |

| | • | | the class and number of shares of our capital stock that are beneficially owned by the person; and |

| |

| | • | | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors under Regulation 14A of the Exchange Act; and |

as to the stockholder giving notice:

| | • | | the name and record address of the stockholder and any other stockholder known to be supporting the nominee; and |

| |

| | • | | the class and number of shares of our capital stock that are beneficially owned by the stockholder making the nomination and by any other supporting stockholders. |

We may require that the proposed nominee furnish us with other information as we may reasonably request to assist us in determining the eligibility of the proposed nominee to serve as a director. At any meeting of

13

stockholders, the presiding officer may disregard the purported nomination of any person not made in compliance with these procedures.

Communications with Our Board of Directors

Any stockholder or interested party who wishes to communicate with our board of directors or any specific directors, including non-management directors may write to:

Board of Directors

Tyler Technologies, Inc.

5949 Sherry Lane, Suite 1400

Dallas, Texas 75225

10

Depending on the subject matter, management will:

| | • | | forward the communication to the director or directors to whom it is addressed (for example, if the communication received deals with our “whistleblower policy” found on our Website,www.tylerworks.comwww.tylertech.com, including questions, concerns, or complaints regarding accounting, internal accounting controls, and auditing matters, it will be forwarded by management to the Chairman of the Audit Committee for review); |

| |

| | • | | attempt to handle the inquiry directly (for example, if the communication is a request for information about us or our operations or it is a stock-related matter that does not appear to require direct attention by our board of directors); or |

| |

| | • | | not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic. |

At each meeting of our board of directors, our Chairman will present a summary of all communications received since the last meeting of the board of directors that were not forwarded and will make those communications available to any director on request.

Director Attendance at Annual Meetings

Directors are not required to attend our annual meetings of stockholders. However, our board of directors typically holds a meeting immediately following the annual meeting of stockholders. Therefore, in most cases, all of our directors will be present at the annual meeting. All of our directors were present at the 20052008 annual meeting of stockholders.

Director Compensation

Each non-employee director receives an annual fee of $15,000, plus $1,000 for each board meeting and $500 for each committee meeting attended.

On May 19, 2005, the board approved discretionary stock option grants to Messrs. Brattain, King, Reeves, and Richards, our non-employee directors. Each received a grant of stock options to purchase 5,000 shares of our common stock. Each of these option grants vests in equal installments on the first, second, and third anniversary of the date of grant and each has an exercise price of $6.14 per share, the quoted market price of our common stock on the date of grant.

1411

SECURITIES OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the beneficial ownership of our common stock as of March 31, 200617, 2009 by (i) each beneficial owner of more than 5% of our common stock, (ii) each director and nominee, (iii) each “Named Executive Officer” (as defined in the SEC’s Regulation S-K), (ii) each director, (iii) each beneficial owner of more than 5% of our common stock, and (iv) all of our executive officers and directors as a group.

| | | | | | | | | |

| Name and Address of Beneficial Owner(1) | | Amount and Nature of Ownership | | Percent of Class(2)(3) | |

MSD Capital, L.P.

645 Fifth Avenue, 21st Floor

New York, NY 10022 | | | 4,049,923 | (4) | | | 10.3 | % |

| | | | | | | | | |

Brown Brothers Harriman & Co.

140 Broadway

New York, NY 10005 | | | 2,981,000 | (5) | | | 7.6 | % |

| | | | | | | | | |

Noonday Asset Management, LP

227 West Trade Street, Suite 2140

Charlotte, NC 28202 | | | 2,570,000 | (6) | | | 6.6 | % |

| | | | | | | | | |

Wentworth Hauser & Violich

353 Sacramento, Suite 600

San Francisco, CA 94111 | | | 2,556,926 | (7) | | | 6.5 | % |

| | | | | | | | | |

| John S. Marr, Jr. | | | 1,903,976 | (8) | | | 4.8 | % |

| | | | | | | | | |

| John M. Yeaman | | | 1,065,150 | (9) | | | 2.7 | % |

| | | | | | | | | |

| Glenn A. Smith | | | 557,571 | (10) | | | 1.4 | % |

| | | | | | | | | |

| Dustin R. Womble | | | 332,467 | (11) | | | * | |

| | | | | | | | | |

| J. Luther King, Jr. | | | 234,300 | (12) | | | * | |

| | | | | | | | | |

| G. Stuart Reeves | | | 195,000 | (13) | | | * | |

| | | | | | | | | |

| H. Lynn Moore, Jr. | | | 160,000 | (14) | | | * | |

| | | | | | | | | |

| Brian K. Miller | | | 114,526 | (15) | | | * | |

| | | | | | | | | |

| Michael D. Richards | | | 70,000 | (16) | | | * | |

| | | | | | | | | |

| Donald R. Brattain | | | 43,500 | (17) | | | * | |

| | | | | | | | | |

| Directors, nominees, and executive officers as a group (10 persons) | | | 4,676,490 | (18) | | | 11.5 | % |

Security Ownership of Directors and Management

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Options | | | | | | | | | | |

| | | | | | | Exercisable | | | | | | | | | | |

| | | | | | | Within 60 | | | | | | | | | | Percent |

| Name and Address of Beneficial Owner (1) | | Direct (2) | | Days (3) | | Other (4) | | Total | | of Class (5) |

| | | | | | | | | | | | | | | | | | | | | |

| MSD Capital, L.P. | | | 4,049,923 | (6) | | | — | | | | — | | | | 4,049,923 | | | | 11.5 | % |

| 645 Fifth Avenue, 21st Floor | | | | | | | | | | | | | | | | | | | | |

| New York, NY 10022 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Brown Brothers Harriman and Company | | | 3,485,013 | (7) | | | — | | | | — | | | | 3,485,013 | | | | 9.9 | % |

| 140 Broadway | | | | | | | | | | | | | | | | | | | | |

| New York City, NY 10005 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Barclays PLC | | | — | | | | — | | | | 2,359,357 | (8) | | | 2,359,357 | | | | 6.7 | % |

| 400 Howard Street | | | | | | | | | | | | | | | | | | | | |

| San Francisco, CA 94105 | | | | | | | | | | | | | | | | | | | | |

| |

| Vaughn Nelson Investment Management, L.P. | | | — | | | | — | | | | 2,292,609 | (9) | | | 2,292,609 | | | | 6.5 | % |

| 600 Travis Street, Suite 6300 | | | | | | | | | | | | | | | | | | | | |

| Houston, TX 77002 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Artisan Partners Limited Partnership | | | — | | | | — | | | | 1,800,800 | (10) | | | 1,800,800 | | | | 5.1 | % |

| 875 East Wisconsin Avenue, Suite 800 | | | | | | | | | | | | | | | | | | | | |

| Milwaukee, WI 53202 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

Directors and Nominees | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Donald R. Brattain | | | 28,500 | | | | 33,333 | | | | — | | | | 61,833 | | | | * | |

| J. Luther King, Jr. | | | 32,000 | | | | 33,333 | | | | 187,300 | (11) | | | 252,633 | | | | * | |

| G. Stuart Reeves | | | 65,000 | | | | 123,333 | | | | — | | | | 188,333 | | | | * | |

| Michael D. Richards | | | 40,000 | | | | 43,333 | | | | — | | | | 83,333 | | | | * | |

| John M. Yeaman | | | 276,300 | | | | 469,000 | | | | 7,300 | (12) | | | 752,600 | | | | 2.1 | % |

| | | | | | | | | | | | | | | | | | | | | |

Named Executive Officers | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| John S. Marr, Jr. | | | 1,027,092 | | | | 664,000 | | | | 192,277 | (13) | | | 1,883,369 | | | | 5.2 | % |

| Dustin R. Womble | | | 174,301 | | | | 343,628 | | | | — | | | | 517,929 | | | | 1.5 | % |

| Brian K. Miller | | | 27,504 | | | | 105,000 | | | | 7,300 | (14) | | | 139,804 | | | | * | |

| H. Lynn Moore, Jr. | | | 80,000 | | | | 110,000 | | | | — | | | | 190,000 | | | | * | |

| | | | | | | | | | | | | | | | | | | | | |

| All directors, nominees and executive officers as a group (9 persons) | | | 1,750,697 | | | | 1,924,960 | | | | 394,177 | | | | 4,069,834 | | | | 10.9 | % |

| | |

| * | | Less than one percent of our outstanding common stock |

| |

| (1) | | Unless otherwise noted, the address of each beneficial owner is our corporate headquarters: 5949 Sherry Lane, Suite 1400, Dallas, Texas 75225. |

|

(2) | | Reported in accordance with the beneficial ownership rules of the SEC. Unless otherwise noted, the stockholders listed in the table have both sole voting power and sole investment power with respect to their |

1512

| | |

| (2) | | “Direct” represents shares subjectas to community property laws where applicable and the information contained in the other footnotes to the table.which each named individual has sole voting or dispositive power. |

| |

| (3) | | “Options Exercisable Within 60 Days” reflects the number of shares that could be purchased by exercise of options at March 17, 2009 or within 60 days thereafter. |

|

| (4) | | “Other” represents the number of shares of common stock as to which the named individuals share voting and dispositive power with another person or trust fund. |

|

| (5) | | Based on 39,227,63735,252,630 shares of our common stock issued and outstanding at March 31, 2006.17, 2009. Each stockholder’s percentage is calculated by dividing (a) the number of shares beneficially owned by (b) the sum of (i) 39,227,63735,252,630 plus (ii) the number of shares such owner has the right to acquire within sixty days. |

| |

(4)(6) | | Based on information reported by MSD Capital, L.P. on a Schedule 13G that was filed with the SEC on or about February 3, 2006. |

| |

(5) | | Based on information reported to us by Brown Brother Harriman & Co. |

|

(6)(7) | | Based on information reported by Noonday Asset Management, L.P. on a Schedule 13G that was filed with the SEC on or about January 30, 2006. |

|

(7) | | Based on information reported by Wentworth Hauser & ViolichBrown Brothers Harriman and Company on a Schedule 13G that was filed with the SEC on or about February 7, 2006.17, 2009. |

| |

| (8) | | Barclays PLC is deemed to have beneficial ownership of these shares. The shares are held by Barclays’ affiliates, Barclays Global Investors, NA., Barclays Global Fund Advisors and Barclays Global Investors, LTD and are based on information reported on a Schedule 13G that was filed with the SEC on or about February 5, 2009. Barclays PLC beneficial ownership includes 1,959,389 shares for which they have sole voting and sole investment power and 399,968 shares for which they have sole investment power. |

|

| (9) | | Based on information reported by Vaughn Nelson Investment Management, L.P., on a Schedule 13G that was filed with the SEC on or about February 17, 2009. Vaughn Nelson Investment Management, L.P. beneficial ownership includes 1,603,425 shares for which they have sole voting and sole investment power, 473,609 shares for which they have shared investment power and 215,575 shares for which they have sole investment power. |

|

| (10) | | Based on information reported by Artisan Partners Limited Partnership on a Schedule 13F that was filed with the SEC on or about February 13, 2009. Artisan Partners Limited Partnership’s beneficial ownership includes 1,652,400 shares for which they have shared voting and sole investment power and 148,400 shares for which they have sole investment power. |

|

| (11) | | Includes the beneficial ownership of (a) 192,277180,000 shares of common stock held in an entity controlled by a partnership in which Mr. MarrKing and he is the general partner and has soledeemed to have voting and investment power, and (b) 200,0007,300 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days.owned by a foundation in which Mr. King is deemed to have shared voting power. |

| |

(9)(12) | | Includes the beneficial ownership of (a) 725,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days and (b) 7,300 shares of commonCommon stock owned by a foundation in which Mr. Yeaman is deemed to have shared voting power. |

| |

(10)(13) | | Includes the beneficial ownership of 30,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days. |

|

(11) | | Includes the beneficial ownership of 160,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days. |

|

(12) | | Includes the beneficial ownership of (a) 180,000 shares of commonCommon stock held in an investmentby a partnership in which Mr. KingMarr is the general partner and is deemed to havehas sole voting and investment power, (b) 7,300 shares of common stock owned by a foundation in which Mr. King is deemed to have shared voting power, and (c) 15,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days.power. |

| |

(13)(14) | | Includes the beneficial ownership of 130,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days. |

|

(14) | | Includes the beneficial ownership of 83,333 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days. |

|

(15) | | Includes the beneficial ownership of (a) 105,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days, and (b) 7,300 shares of commonCommon stock owned by a foundation in which Mr. Miller is deemed to have shared voting power. |

|

(16) | | Includes the beneficial ownership of 30,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days. |

|

(17) | | Includes the beneficial ownership of 15,000 shares of common stock issuable upon the exercise of stock options that are exercisable within sixty days. |

1613

| | |

(18) | | Includes: (a) 1,493,333 shares of common stock that are issuable upon the exercise of stock options that are exercisable within sixty days; (b) 372,277 shares held by a partnership in which named persons have sole voting and investment power; and (c) 21,900 shares of common stock held in a foundation in which named persons have sole or shared voting and/or investment power. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act requires that our directors, executive officers, and 10% or more stockholders file with the SEC and New York Stock Exchange initial reports of ownership and reports of changes in ownership of our common stock. These persons are required to furnish us with copies of all Section 16(a) reports they file with the SEC. To our knowledge, based solely onupon (i) our review of the copies of the forms we received during 20052008 and without further inquiry,(ii) written representations from our directors and executive officers we believe that all of our directors, officers, and 10% or more stockholders complied with all Section 16(a) filing requirements during 2005.2008 except for one transaction subsequently reported on an amended Form 4. Mr. Yeaman inadvertently did not file a Form 4 in a timely manner with respect to a stock option exercise of 91,950 shares of our common stock.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

2008 was a year of exceptional performance for Tyler Technologies (the “Company”), particularly in light of the global economic environment and the crisis in the financial markets. The Company’s revenues grew 21% to $265 million, with software-related revenues up 25%. Software license revenue growth of 18% was very solid, even as our software-as-a-service model continued to gain traction, resulting in a 38% increase in subscription revenues. For the year, our gross margin improved by 300 basis points and the Company posted non-GAAP operating income of $37.1 million, up 39% over 2007. Non-GAAP earnings per share rose 45% to $0.61. Free cash flow (excluding office facility investments) increased 40% over 2007 to $42.3 million (cash provided by operating activities of $47.8 million minus capital expenditures, excluding capital expenditures for office facilities, of $5.5 million). The Company’s common stock price at December 31, 2008, was $11.98, down 7% from $12.89 at December 31, 2007. By comparison, the Standard and Poor’s 500 declined 37% in 2008.

GAAP operating profit was $28.1 million and GAAP earnings per share was $0.38. Non-GAAP earnings per share of $0.61 and non-GAAP operating profit of $37.1 million excludes a non-cash legal settlement related to warrants charge of $9.0 million, which was not tax deductible. On June 27, 2008, we settled outstanding litigation related to two Stock Purchase Warrants (the “Warrants”) owned by Bank of America, N. A. (“BANA”). The Warrants entitled BANA to acquire 1.6 million shares of Tyler common stock at an exercise price of $2.50 per share. Following court-ordered mediation, in July 2008, BANA paid us $2.0 million and we issued to BANA 801,883 restricted shares of Tyler common stock. We excluded this non-cash charge from non-GAAP measures because it was a non-cash settlement unrelated to the Company’s core operations, and we believe this settlement actually increased shareholder value by diminishing the impact of the warrants on future diluted earnings per share.

Executive Summary

The Compensation Committee is responsible for reviewing, and approving the design and overseeing the administration of our executive compensation program.

The primary objectives of our executive compensation program are to:

| • | | attract and employ outstanding management in order to obtain outstanding results; |

|

| • | | provide a strong link between annual and long-term cash and stock incentives to the achievement of measurable corporate performance objectives; and |

|

| • | | align executive incentives with stockholder value. |

14

To achieve these objectives, the executive compensation program relies on the following elements of total compensation:

| | | | | | |

| | Form of | | | | |

| Element | | Compensation | | Purpose | | Metric |

| | | | | | |

| Base salary | | Cash | | Provide competitive, fixed compensation to attract and retain exceptional executive talent | | Salaries are set each year based on the executive’s position and responsibilities |

| | | | | | |

| Incentive cash compensation under the bonus plan | | Cash | | Create a strong financial incentive for achieving or exceeding annual financial goals | | Achieving earnings per share goals |

| | | | | | |

| Equity-based compensation | | Stock options | | Create a strong financial incentive for creating shareholder value and encourage a significant equity stake in the Company | | Discretionary but set each year based on the person’s position and responsibilities |

Our executive compensation program is designed primarily to incentivize and reward the achievement of both short-term and long-term objectives and the creation of shareholder value. To achieve these objectives we use a mix of short-term compensation (base salaries and annual cash bonuses) and long-term incentives (stock options) to provide a total compensation structure that is designed to reward outstanding performance and provide cash compensation at or slightly above the median for our industry. In setting the mix between the different elements of compensation, we do not target specific allocations, but generally weight total target compensation more heavily toward incentive compensation, which comprises both cash and equity. Base salary and cash incentives are intended to reward short-term objectives, while equity incentives, comprised of stock options, are intended to reward achievement of long-term objectives through time-based vesting periods. Our bonus plan is based on annual earnings per share performance metrics, with similar benefits for overachievement and consequences for underachievement, with bonuses paid soon after the fiscal year ends. Stock options to our executive officers vest over a period of five years, thereby providing a long-term incentive. Our allocations reflect our philosophy that a significant portion of our executive officers’ compensation should be performance-based and therefore at risk depending on the Company’s performance. Through the use of stock options, a significant portion of potential compensation is tied directly to stock price appreciation, further aligning the interest of our executive officers with those of our stockholders.

Our Compensation Committee is responsible for determining and approving executive officer compensation each year. The Compensation Committee, using its judgment, may exercise discretion in granting additional bonus amounts and stock option awards as it deems appropriate. These adjustments may be based on subjective factors such as the Compensation Committee’s assessment of external factors, including general economic and market conditions, the executive’s assumption of additional responsibilities, the degree of difficulty of a particular assignment, and the executive’s experience, tenure and future prospects with the Company.

Role of the Chief Executive Officer

The Compensation Committee determines the compensation of our named executive officers, including the chief executive officer. In February 2008, our Chief Executive Officer, John S. Marr, Jr., provided the Compensation Committee with recommendations for 2008 base salary increases, annual bonus performance targets and related minimum and maximum bonus payout potentials and long-term incentives (stock option awards) for each executive, including Mr. Marr. His recommendations were based on his review of internal pay relationships and consistency, the executive’s performance and experience, level of responsibility, changes in responsibilities, retention risk and market compensation survey data provided by the Company’s Human Resources department. Bonus payout potentials were based on the level of earnings per share achieved compared to earnings per share goals developed in connection with our annual operating plan at the beginning of the 2008 fiscal year. The Chairman of the Board attended the Compensation Committee meeting in February 2008 and presented Mr. Marr’s recommendations for 2008 compensation packages to the Compensation Committee and participated in the Committee’s discussion of executive compensation. Mr. Marr did not attend any Compensation Committee meetings in 2008.

In February 2009, Mr. Marr attended the meeting of the Compensation Committee and participated in a discussion of senior management’s philosophy regarding executive compensation and short and long-term objectives. Mr. Marr also discussed the compensation mix of base salary, short-term incentive compensation

15

(annual bonus) and long-term incentive compensation (stock options), as well as metrics that the Company believes are important in evaluating Company performance, including growth in revenue, free cash flow and earnings per share. He reviewed the Company’s five year history as well as projected 2009 growth rate for each performance metric. In addition, Mr. Marr reviewed the Company’s 2008 financial performance. Mr. Marr made recommendations for 2009 salary adjustments for the executive officers, including Mr. Marr, based on the Company’s 2008 performance and his recommendations were consistent with company-wide guidelines for all employee salary adjustments. In addition, Mr. Marr also reviewed internal pay relationships and consistency, the executive’s performance and experience, level of responsibility, changes in responsibilities, retention risk and market compensation survey data provided by the Company’s Human Resources department in determining his salary adjustment recommendations. Mr. Marr was excused from the meeting after his presentation and did not participate in the Compensation Committee’s discussion of executive compensation for 2009. The Compensation Committee has the authority to accept, reject or modify the chief executive officer’s recommendations. The Compensation Committee accepted the chief executive officer’s recommendations for 2009.

Analysis of Compensation Elements

The principal elements of our executive compensation program in 2008 are described below:

Base Salary. Base salary represents the single, fixed component of the three principal elements of our executive compensation program and is intended to provide a baseline minimum amount of annual compensation for our executives. In February 2008, the Compensation Committee approved the following increases to the executive officers’ 2008 annual base salary, based largely on the chief executive officer’s recommendation and consistent with company-wide guidelines for all employees:

| | | | | | | | | | | | | |

| Name | | Increase | | 2007 Salary | | 2008 Salary |

| John S. Marr, Jr. | | | 4 | % | | $ | 380,000 | | | $ | 395,000 | |

| Dustin R. Womble | | | 4 | % | | $ | 320,000 | | | $ | 333,000 | |

| Brian K. Miller | | | 6 | % | | $ | 235,000 | | | $ | 250,000 | |

| H. Lynn Moore, Jr. | | | 6 | % | | $ | 235,000 | | | $ | 250,000 | |

The chief executive officer’s recommendations were based on reference to nationwide market surveys and his evaluation of each named executive officer’s performance.